What Is Employee Mileage Reimbursement?

Employee mileage reimbursement is when employers pay employees for expenses associated with driving their personal vehicles on behalf of the business. These payments aim to cover the cost of fuel and vehicle costs such as maintenance and depreciation.

To make these calculations practical, employee mileage reimbursement is calculated at a per-mile rate. The IRS provides guidance on what the mileage reimbursement rate should be and is continually updating its rate to reflect the rising costs of gas and other inflationary pressures on vehicle costs.

Having an effective employee mileage reimbursement policy requires both complying with both the minimum state and federal level rules, as well as making sure you have a competitive policy that fairly compensates employees for their expenses that is operationally practical to implement. In other words, you need to be careful you can effectively manage the employee mileage reimbursement policy so that you don’t end up overpaying employees for mileage because it has been poorly tracked and managed.

Are You Required To Have An Employee Mileage Reimbursement Policy?

When employees travel for work purposes, they need to be paid for their travel time. But do they need to get paid for mileage?

If employees are using a company vehicle, they will still need to get paid for their travel time. They won’t necessarily be reimbursed for mileage because they aren’t using their own car or gas, but you may still want to track mileage for financial reasons.

If your employees are using their personal vehicles, it becomes slightly more complicated.

Federal labor laws do not explicitly require employers to reimburse employees for mileage when using their personal vehicles. The exception is if the costs of using their personal vehicle would bring the employee under minimum wage—then the employee should be reimbursed to be brought up to minimum wage.

It’s important to note that there are three states that do explicitly require companies to reimburse their employees for mileage: California, Massachusetts, and Illinois.

What States Require Mileage Reimbursement?

If your business employs people in any of the following three states:

- California

- Illinois

- Massachusetts

You are required to reimburse your employees for many expenses that they incur on behalf of your company while working, this includes the costs associated with using your personal vehicle for work-related purposes of which mileage is included. It’s important to note that these costs are not limited to mileage, they also include:

- vehicle depreciation,

- repair and maintenance expenses,

- lease payments

- parking fees,

- vehicle registration, and

- vehicle insurance.

The IRS publishes a standard mileage reimbursement rate that is designed to cover all these costs. Most companies choose to use the standard IRS mileage rate because most courts typically recognize it as the correct amount to be applied, though there are other methods as well.

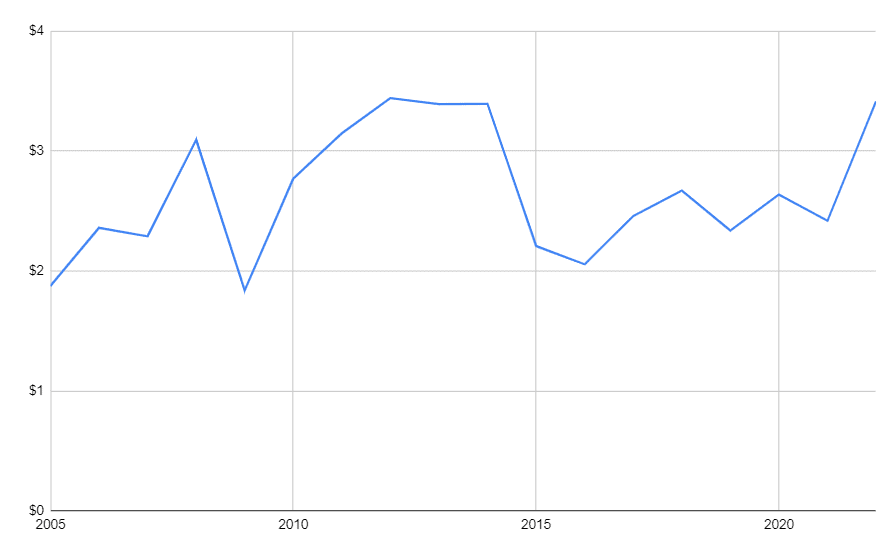

IRS Mileage Reimbursement Rates In 2023

The IRS is continually updating its standard mileage reimbursement rate to reflect the inflationary pressures on the cost of gas and maintaining a vehicle. As of the 1st of January 2023, the IRS standard mileage reimbursement rate for businesses is 65.5 cents per mile. The current mileage reimbursement rates will be in effect until the end of the year. The rates do rise every year, so you can expect to see a regular increase in the IRS’s posted mileage amounts.

Not all employers use the IRS standard mileage rates when setting their mileage reimbursement policy. The IRS standard mileage rate is a national average based on the previous year’s data. It is more useful for tax deduction purposes than for setting a true reimbursement rate as it doesn’t factor in local factors. For example, the cost of gas can vary significantly across the United States. Although rare, some employers have a company mileage reimbursement policy that aims to reflect a more accurate cost than the IRS rate by setting their own cost per mile for each of their employees.

Tax Deductions Relating To Mileage Reimbursement

There are some definite tax breaks available to you when it comes to mileage reimbursements. The most significant is that you can deduct employee travel expenses (including mileage) from your taxes. But to do so, you need to keep careful track of all your travel—including where your employees went and why.

In addition, mileage reimbursements are not considered income to an employee and therefore nontaxable and treated separately from an employee’s net pay. When executing your payroll, be sure to enter mileage reimbursements as an expense reimbursement so they are not-taxed.

How to Calculate Mileage Reimbursement

So once you have determined that your company is going to pay mileage reimbursement as a policy and you have decided on the mileage reimbursement rate you are going to use, calculating mileage reimbursement is simple.

Here’s the formula for how to calculate mileage reimbursement:

Mileage Reimbursement = Miles driven x Mileage Rate

For example, if an employee traveled 200 miles for work in a week and you are using the standard IRS mileage rate of 62.5 cents per mile, the mileage reimbursement calculation would be as follows:

Mileage Reimbursement = 200 miles x 62.5 cents = $125

As you can see calculating mileage reimbursement is very simple, the hard part is accurately tracking mileage for each of your employees. The following questions arise:

- How do you make their mileage reimbursement claim doesn’t include mileage outside of work?

- How do you know they are being honest if they are self-reporting mileage reimbursement?

- How do you collect all of the mileage reimbursement claims across your whole team in an efficient way in time for payroll every week?

The good news is that there are tools you can use to solve these problems and make your employee mileage reimbursement program accurate and efficient, more on this in the next section.

Options For Tracking Employee Mileage Reimbursements

There are typically three ways of tracking and capturing mileage reimbursements: Self-reported manual logs, GPS tracking apps or devices, and GPS time clock apps. While they all have pros and cons, time clock apps with in-built mileage tracking give you the most reliable, efficient, and accurate solution.

Self-Reporting With Manual Logs

Some employers often just use paper logs to track employee hours. Employees would fill out their mileage reimbursement on paper whenever they travel for work including miles driven, and even sometimes including photos of odometer readings as evidence, however, these logs can be quite cumbersome, especially if an employee is visiting multiple sites each day.

Manual mileage logs have the same problems as paper timesheets. They are often inaccurate and easily forgotten about. While this system is fast and easy to set up, it will hinder efficiency and accuracy day to day.

If you are using manual mileage reports, you’re probably overpaying for mileage reimbursement across your whole team. It’s likely to be costing you thousands of dollars not to mention the admin time your whole crew is spending collecting the mileage reports, sharing them, and then performing the calculations.

GPS Tracking Devices

One of the most accurate ways to track employee mileage is via GPS trackers for company vehicles. These devices can be placed in company vehicles or given to employees to carry with them. When employees travel, the device tracks not only routes and mileage but also safe driving habits.

GPS tracking devices are accurate, but they’re expensive and the most fundamental problem is that they are not directly tied to the employee’s timesheet for the day. Many employers, especially smaller contractors, don’t want to spend money outfitting all their employees with GPS tracking devices, especially when they drive their own vehicles—it’s an unnecessary added expense. Additionally, any information gathered from separate GPS tracking devices will need to be reviewed and parsed out separately which makes the data collection and consolidation process more difficult and inefficient.

Recommended: GPS Time Clock Apps

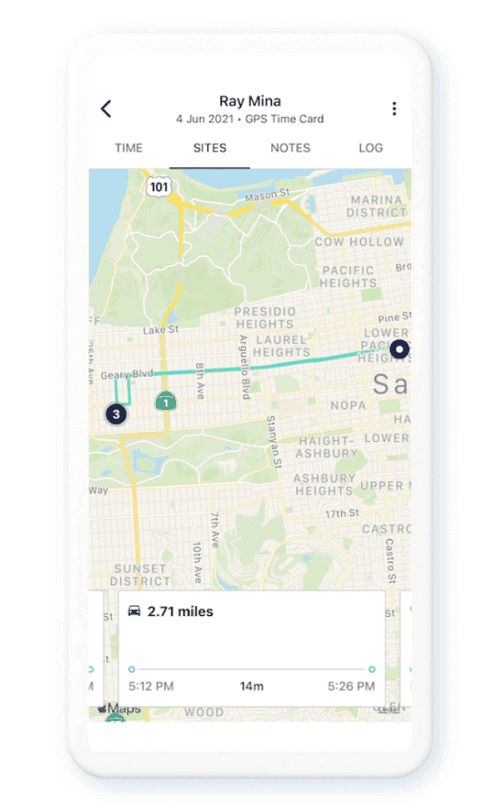

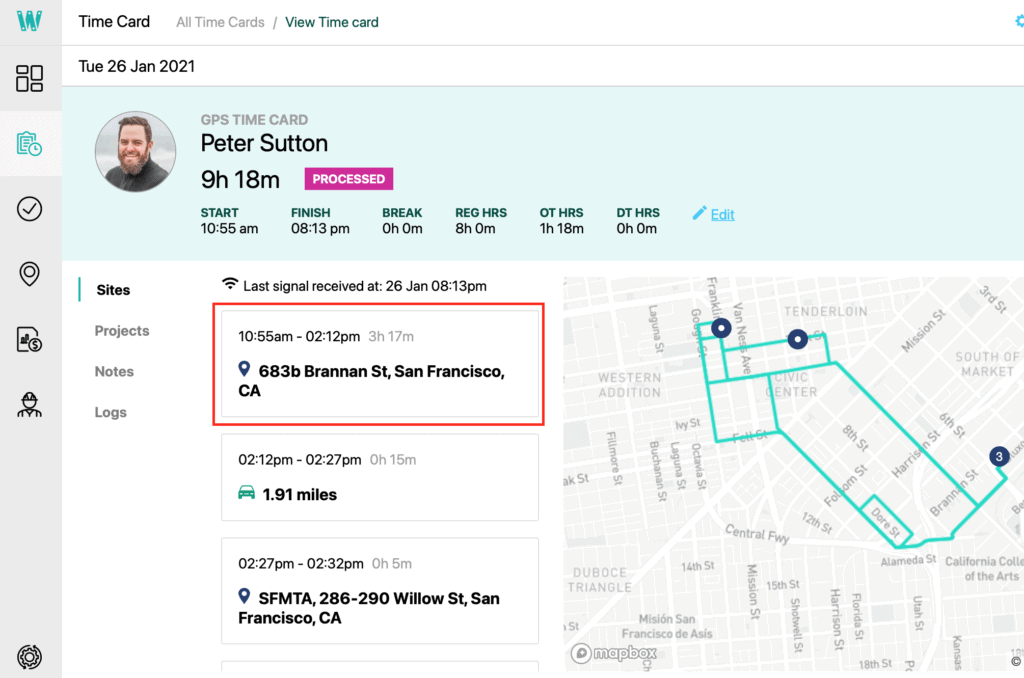

Finally, there are GPS-powered time clock apps that make mileage tracking a breeze. A construction time clock will allow you to monitor what your employees are doing throughout the day and ensure that their mileage and drive times align with their time cards. These apps perform the same function as a GPS tracking device, but there’s no equipment cost; the app uses the GPS technology provided by the phone. Today, this GPS technology is highly accurate.

The best part is the employee’s mileage and travel throughout the day are directly tied to their timesheet where you can see their clock-in time, lunch break, and clock-out time.

Apps like Workyard will go one step further and automatically calculate the mileage traveled between each job site visit, and give you a simple report of each employee’s mileage by day and by week.

GPS-powered time clock apps also give you the added benefit of automatically calculating travel time pay for hourly employees for you in situations where you are paying workers different rates for travel time. This is also useful data that can help you identify if your employees are spending too much time traveling vs working on job sites.

The Advantages of Digital Mileage Tracking

Let’s look at some of the advantages of using apps to capture and track your mileage electronically.

100% Transparency = Peace of mind

With a GPS time clock app in place, you always where your employees are for every minute they have worked, including whether they were driving and exactly how many miles they racked up. This transparency across your team reduces disputes and also takes the stress off your employees having to worry about recording their miles accurately, they just clock out every day and the app takes care of the rest.

Compliance

Another advantage of tracking employee mileage accurately with a digital solution is that you have a detailed log of evidence to support every employee mileage reimbursement you have made.

These records become invaluable in the event of a pay dispute with a certain employee because they provide concrete evidence that you reimbursed them accurately.

The IRS also requires businesses to keep detailed records of business expenses, including mileage. The IRS also roughly knows how much any business should be reporting as mileage. In the event of an IRS audit, having detailed support for all of your mileage claimed becomes invaluable.

Improved Client Reimbursements

If you bill your clients for travel expenses, accurate mileage tracking is essential. When you have GPS data or detailed mileage logs, you’re not just confident that you’re billing correctly—you have the paper trail to back it up. Improve relationships with clients and make it easier to get reimbursed.

Better Budgeting Insights

Tracking employee mileage can also give you better insights into your business budget. When you know how much your employees are traveling, you can make informed decisions about where to allocate your resources. You can also fine-tune your scheduling and your site management to reduce travel and improve efficiency.

Accurate Employee Mileage Tracking With Workyard

If you’re looking for an easier way to track employee mileage, look no further than Workyard. Our GPS time clock app makes it simple and easy to track employee travel and mileage —so you can get the most accurate picture of your company’s mileage costs.

Key features Workyard offers that make mileage tracking easy:

- Accurate mileage is automatically captured with every time card, including a breakdown of every trip, driving route, and mileage for that trip. No manual data entry by workers or your office is required.

- Mileage can also be also automatically allocated to projects based on driving destination.

- Convenient mileage reporting gives you a summary of driving time and mileage by employee and project.