The Current State of Construction Labor Shortage

- Construction work today employs about 7.7 million people in the US.

- According to a report by the Associated General Contractors of America (AGC), 89% of construction firms faced challenges in hiring skilled workers in 2023.

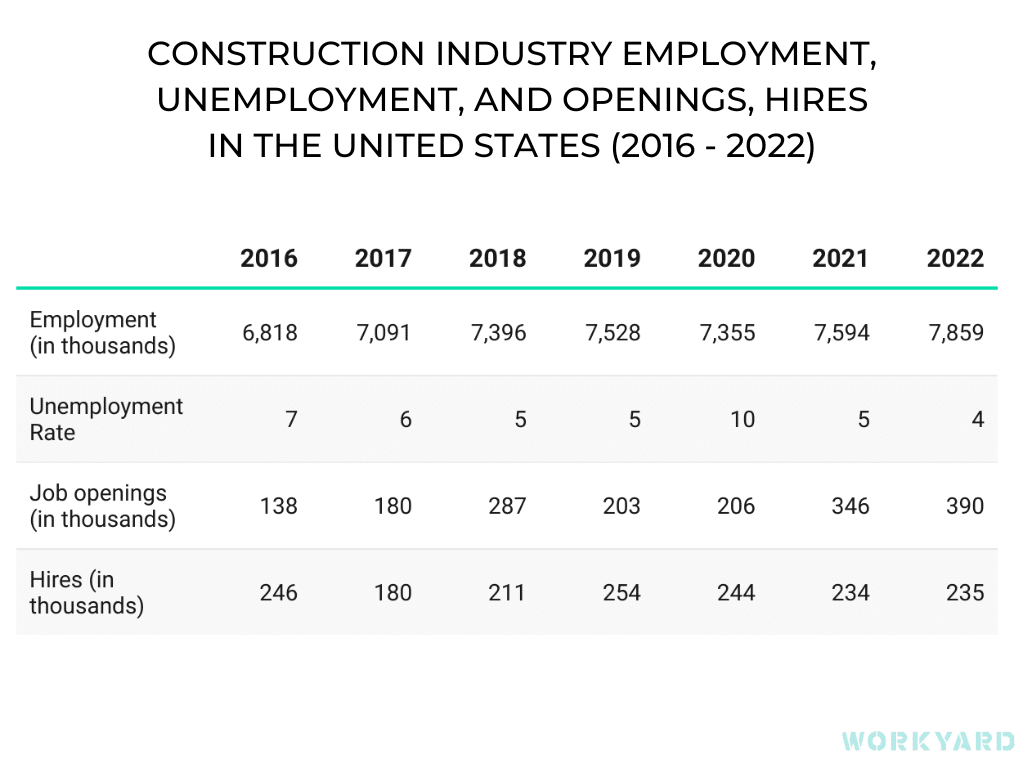

- The construction industry averaged more than 349,000 job openings per month in 2023 (Jan-May), and the industry unemployment rate averaged 5.05% in 2023 (Jan-June).

- Construction employment averaged 7.893.000 in Jan-Apr 2023. For comparison, in the first 4 months of 2022, it was 7.662.000.

- The construction industry quit rate, or the share of construction workers who quit their jobs averaged 2.5% during the first 5 months of 2023. Over the previous decade, the construction industry’s quit rate averaged just 1.8%.

- The labor shortfall has caused contractors to hold on to workers they otherwise wouldn’t. 4.2% of all construction workers were laid off in the first two months of 2023.

Tracking The Construction Labor Shortage Over Time

- The following table shows the construction industry’s employment statistics and recent unemployment rates. The data indicates that only in 2020 employment had decreased compared to the previous year. And also unemployment rate was at its peak again in 2020.

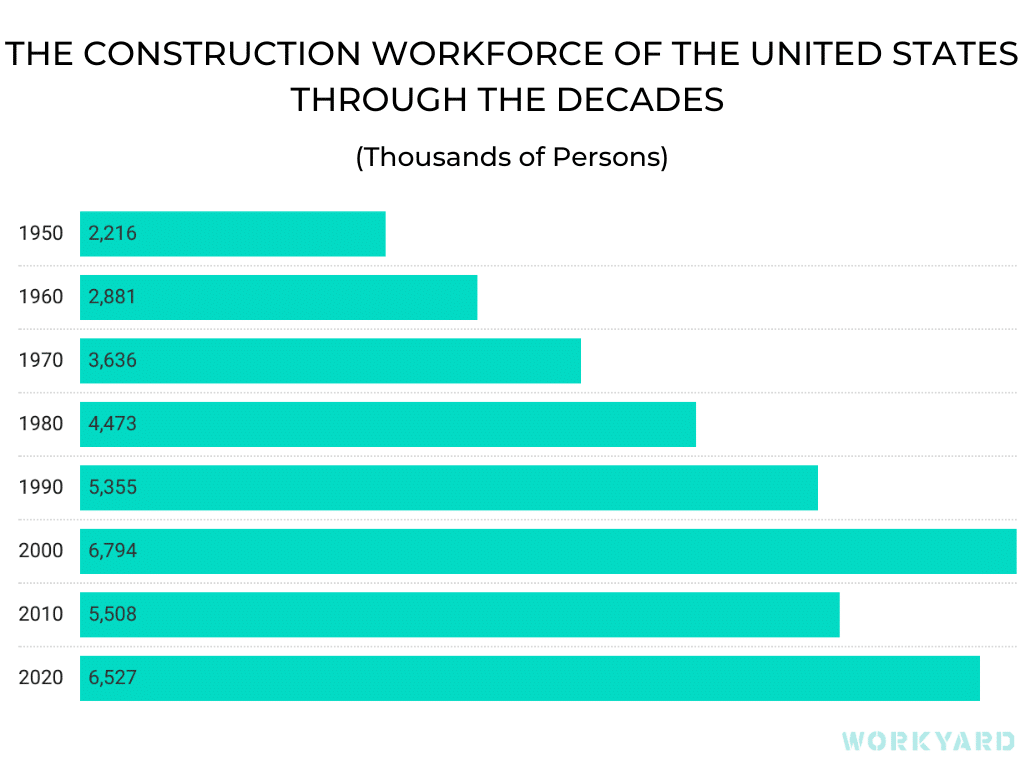

- The construction workforce of the US raised from 2,2 million (in 1950) to 6,5 million people (in 2020) in the last 70 years.

Factors Contributing to Construction Labor Shortage

1.Pandemic

- According to the Bureau of Labor Statistics, nearly 8 million skilled-labor jobs were lost from the labor force during the pandemic. About half have been filled, but about 4 million vacancies remained in industries responsible for most transportation, construction, and mechanical needs nationwide.

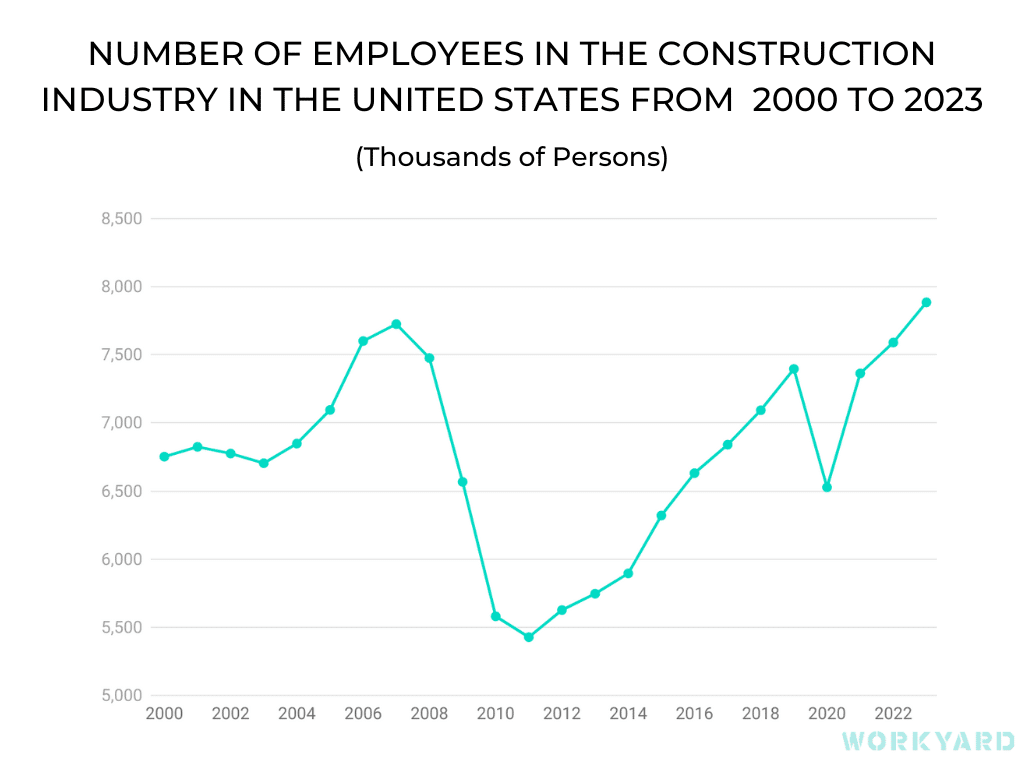

- The construction sector employed nearly eight million people in the US in early 2023, which was the highest number since the start of the COVID-19 pandemic. There is a strong correlation between the amount of investment in construction and the demand for workers. For example, in the years following the 2008 financial crisis, the value of new construction put in place in the U.S. also decreased.

- As of January 2023, there are roughly 7.9 million people on construction payrolls. That’s about 3.6% more employees than the industry had at the start of the pandemic.

- The construction industry has slowly begun to recover jobs lost in the early months of 2020. In the first two months of the pandemic, construction lost about 1.1 million jobs, a decline equivalent to 14.2% of the industry’s workforce.

2. Retirement age

- According to the U.S. Bureau of Labor Statistics, the average age for construction workers is 42.4 years old.

- With nearly 1 in 4 construction workers older than 55, retirements will continue to whittle away at the construction workforce. Many of these older construction workers are also the most productive, refining their skills over time. The number of construction laborers, the most entry-level occupational title, has accounted for nearly 4 out of every ten new construction workers since 2012. Meanwhile, the number of skilled workers has grown at a much slower pace or, in the case of certain occupations like carpenter, declined. Simply put, the construction industry’s workforce is as old as it’s ever been. Just one in ten construction workers is 24 years or younger.

- Over 40% of the current US construction workforce is expected to retire over the next decade. In addition, the current shortage of some 430,000 construction-industry workers is fully expected to expand over the next two years. But looking on the bright side, nonresidential construction firms did add 20,800 employees in November 2021, following a pickup of 34,600 the month prior. And while there has been an increase in workers, nonresidential employment remains 209,000 below the February 2020 level, as the sector has recovered only 67% of the jobs lost in the first two months of the pandemic.

- If all construction workers were to retire at the age of 61, which is the average age of retirement, according to the CDC, approximately one-quarter of the industry workforce would be retired by 2028.

3. Risks

- According to NordLocker, construction holds the #2 spot for being the most targeted industry for ransomware attacks between January 2020 and January 2022.

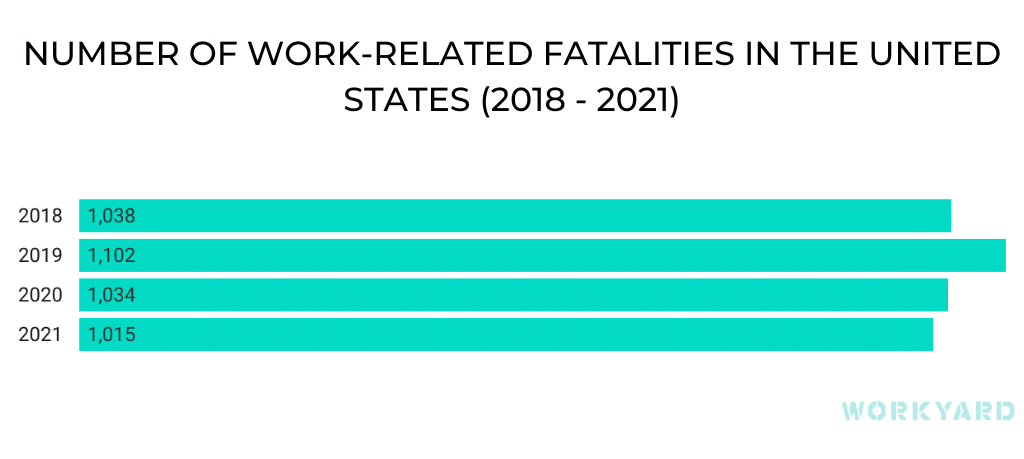

- Also, other risk factors are injuries and fatalities, which are work-related. The chart shows the number of such fatalities in the US for the last four years.

4. Salary

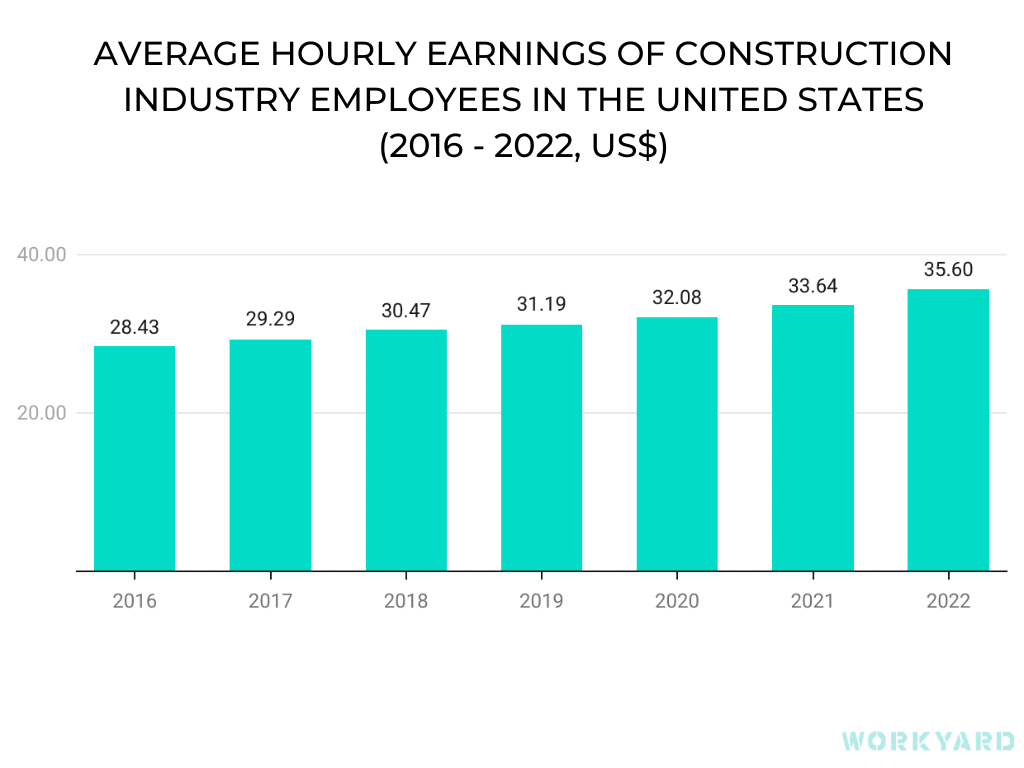

- The average hourly salary of construction workers experienced a minor increase in the last seven years (from $28 to $35). But compared to other more profitable industries, the financial factor plays a huge role in the problem of labor shortage.

5. Rising Costs

- According to the Bureau of Labor Statistics, the consumer price index rose 8.2% over the past 12 months. The biggest increases were shelter, food, and medical care. As these costs continue to rise, your workers will either demand a higher wage to cover them or look at competitors who will pay them more.

6. Low interest of young people

- It will be difficult to boost numbers in construction when so few young people are entering the industry. According to the BLS, 61.8% of 2021 high school graduates ages 16 to 24 were enrolled in colleges or universities. The focus on higher education over trade has steadily increased over the past 40 years. According to the National Center for Education Statistics, in 1969, there were 8 million students enrolled in postsecondary institutions, and in 2019, 19.6 million were enrolled.

Sector View of Construction Labor Shortage

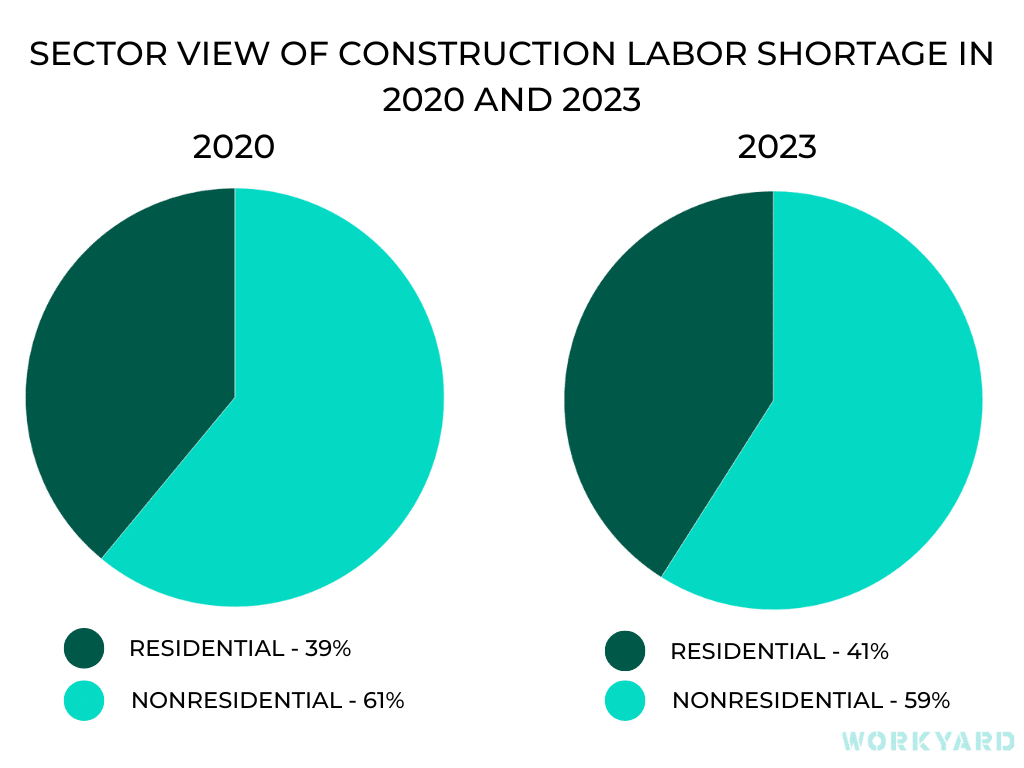

- The residential sector, buoyed by a boom in new home construction, has gained employees at a faster pace than the nonresidential sector over the past two years. Residential construction accounted for 39.0% of all construction workers at the start of the pandemic. As of January 2023, that share had risen to 41.4%.

- Nonresidential construction has recovered jobs at a slower pace due to behavioral changes such as the increased prevalence of remote work and e-commerce. The nonresidential industry has fared less well, and that’s reflected in the segment’s workforce, which is currently 0.5% smaller than at the start of the pandemic.

Occupation View of the Construction Industry

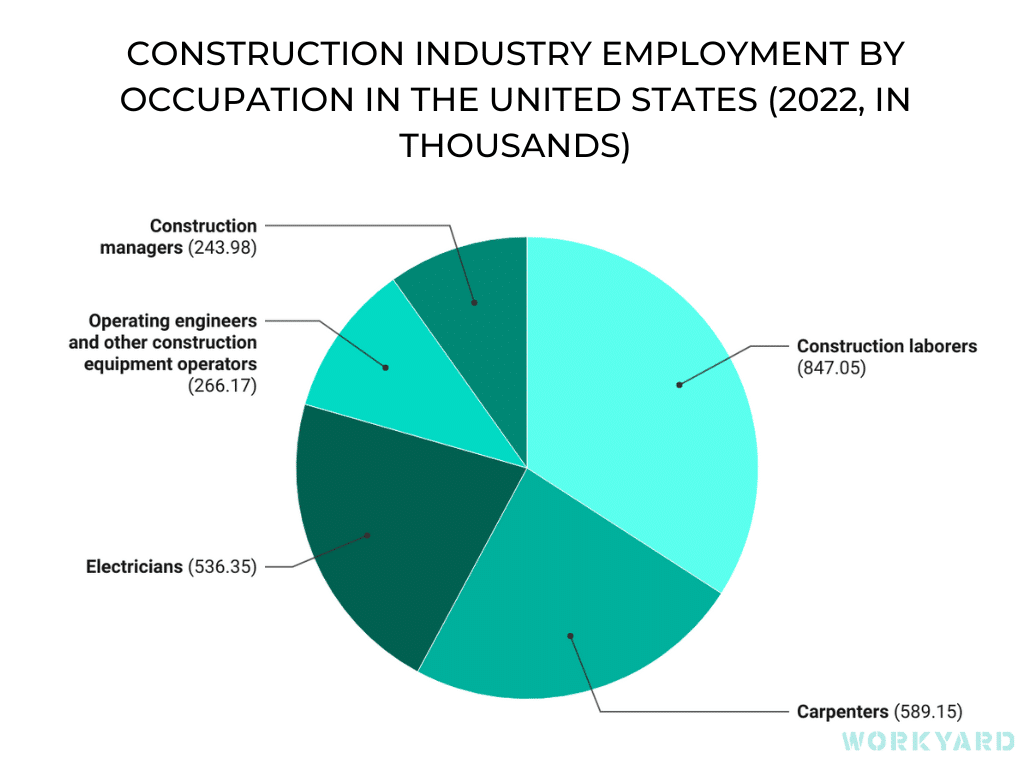

- The construction industry’s employment view by occupation is presented in the following chart.

Competing with Other Industries for Workers

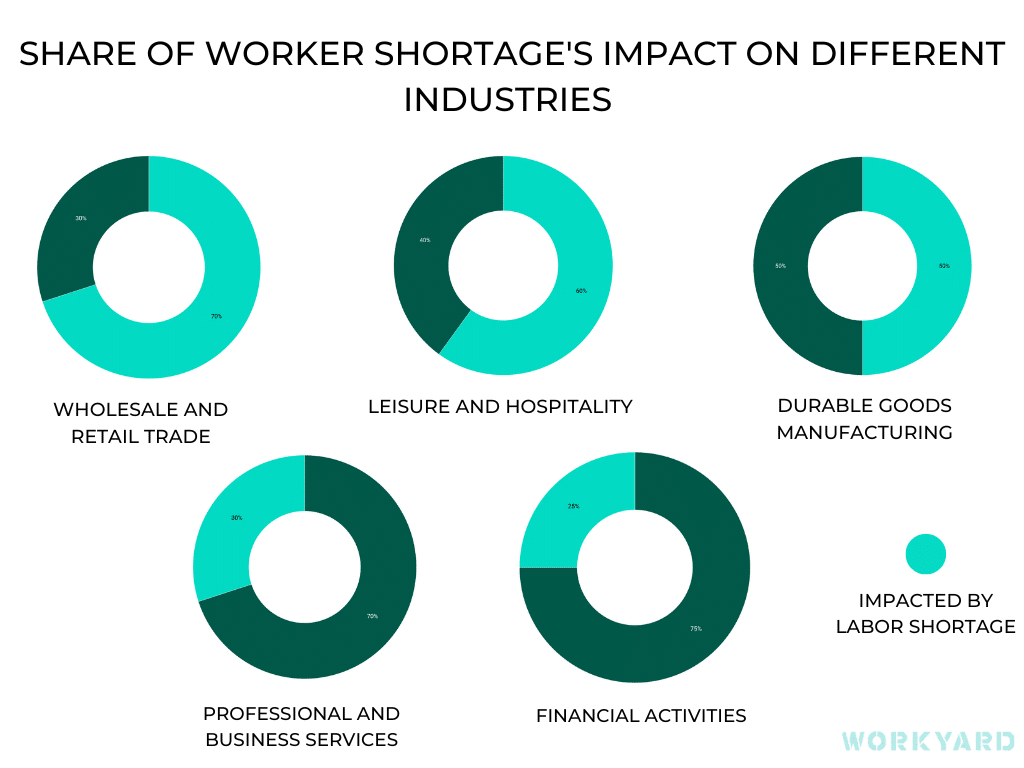

- Construction isn’t the only industry that is experiencing worker shortages. In 2021, more than 47 million workers quit their jobs looking for better work/life flexibility, better pay, and strong company culture. And while construction is reeling from worker shortage, it isn’t the only one. According to the U.S. Chamber of Commerce, labor shortages are impacting:

- Wholesale and retail trade – 70%

- Leisure and hospitality – 60%

- Durable goods manufacturing – 50%

- Professional and business services – 30%

- Financial activities – 25%

With several industries facing worker shortages, construction companies will have to work even harder to recruit workers for not only their company but the industry as a whole.

Predictions about the Future of the Construction Industry

- The construction industry will need to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet the demand for labor.

- ABC predicts demand for labor to increase by 3,620 new jobs for every $1 billion in new construction spending, on top of the above-average job openings.

Conclusion

The construction industry is confronted with a significant labor shortage. Different factors resulted in it, including the impact of the pandemic, an aging workforce, rising costs, and competition from other industries. Addressing this shortage will require strategic initiatives to attract and retain skilled workers and promote the benefits and growth opportunities within the construction sector.

If you use these insights, please provide a link to Workyard at https://www.workyard.com/. A linked credit allows us to keep supplying you with content that you may find useful in the future.

For more information, please email at: ariga@workyard.com