An Overview Of How Job Costing in QuickBooks Online Works

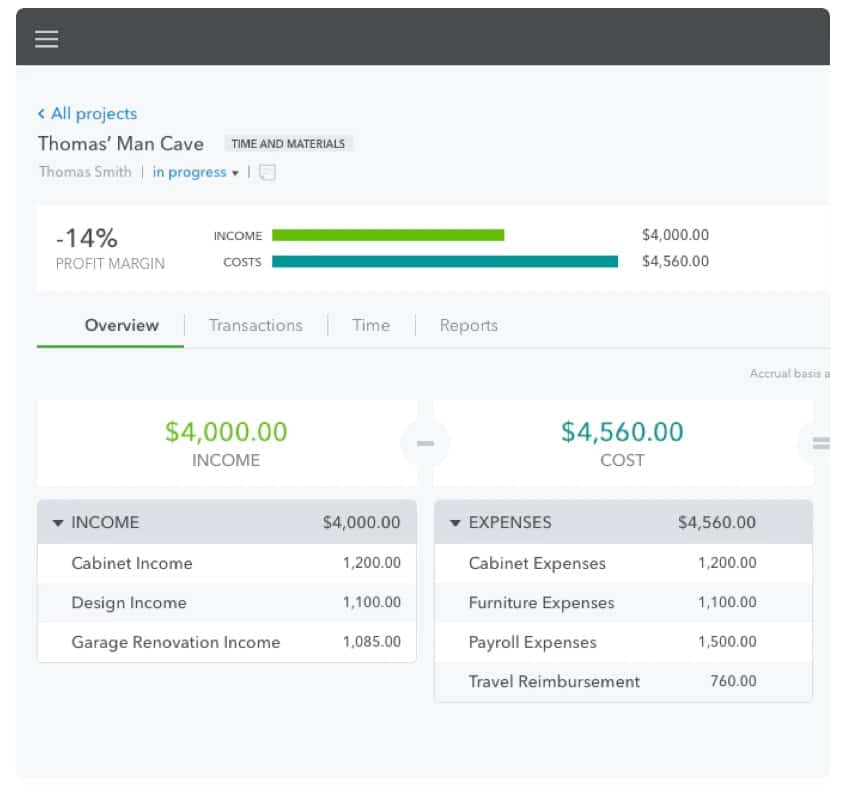

In QuickBooks Online, job costing begins with allocating expenses to specific jobs. Job costing reports provide an overview of how much each job has cost so far—so you can determine whether you’re making or losing money on the job. You can pull job costing reports while a project is still active to determine where you are relative to your budget.

You can also pull job costing reports after you’ve finished a job to see your profit margin and make tweaks in future bids. Your job costing reports will include a brief overview, transactions assigned to the project, and the time spent working on the project.

How Do You Create a Job Costing Report in QuickBooks Online?

Creating a job costing report requires that you book all your expenses in QuickBooks on a project-by-project basis; in other words, you should allocate every project-related expense you book in QuickBooks to a project.

The three main types of expenses you are going to be booking to jobs:

- Labor

- Materials

- Vendors

Let’s look at how you can quickly and easily create a job costing report.

1. Set Up a “Customer” and a “Job” for Each Job

Before you pull your job costing reports, you will need to create customers and projects to track.

- In QuickBooks, go to the “Customers” menu and select the “Customer Center.”

- Click the “New Customer & Job” button at the top of the page.

- Select the appropriate customer from the list, or create a new one.

- Enter information about the job in the “Job Information” section, such as the job name, start date, and job status.

- Click OK to save the customer and job information.

Here’s a quick video on how to setup projects in QuickBooks:

2. Begin To Assign Your Labor & Material Expenses to Jobs

There are different ways to record different types of expenses in QuickBooks. Labor is can be the most challenging to track accurately, this is where we’ll spend most of our time here.

Recording Labor Expenses

Labor expenses are entered via the timesheets module. When each time entry is entered you can tag it to a specific job and service item you have setup in QuickBooks.

If you use QuickBooks to run your payroll, after running a payroll, labor expenses will be automatically allocated to jobs that have been tagged. This includes payroll tax expenses which make up part of your complete labor burden for each employee.

Hourly labor is very difficult to track and attribute to jobs accurately, and being wrong by 10-20% can cost you a lot of money. To ensure this is accurate and to reduce headaches use a time tracking app that integrates with QuickBooks.

A time tracking app will allow you to easily capture time sheets every day attributed to jobs and service items and then also automatically feed this data to QuickBooks for you to streamline your job costing.

Here’s a video of how the Workyard time tracking app can make this process much easier for you:

Recording Material, Vendor & Other Expenses

QuickBooks Online makes it easy for you to record material, vendor and any other expenses related to your projects.

If you’ve already paid for an expense, you enter it as an expense. On the other hand, if you plan to pay for the expense in the future, you should enter it as a bill. These are specific types of transactions that inform QuickBooks Online how to apply the correct accounting methods to each expense.

Here’s a quick video of how to enter and manage expenses in QuickBooks:

3. Enter Estimates For Each Each Job

You can create your estimates in QuickBooks, send them to customers, and then convert them into invoices after you complete the work. By using Estimates you also are setting a budget breakdown for each of jobs in QuickBooks Online.

By doing so you get the added benefit of being able to track your actual costs versus your original budget on the QuickBooks Online job dashboard.

Here a quick video on how to create estimates in QuickBooks Online:

4. Use Job Costing Reports To See How Your Expenses Are Tracking For A Job

Ideally, you should pull job costing reports regularly to ensure that you aren’t losing money on any of your jobs. Set aside time every week to do so.

QuickBooks Online gives you a convenient dashboard for tracking project profitability at a high level, comparing your budget to your actuals. You can also drill and run specific reports for time costs by employee or vendor and unbilled time and expenses.

Here’s a quick video on how the job costing reports work in QuickBooks Online:

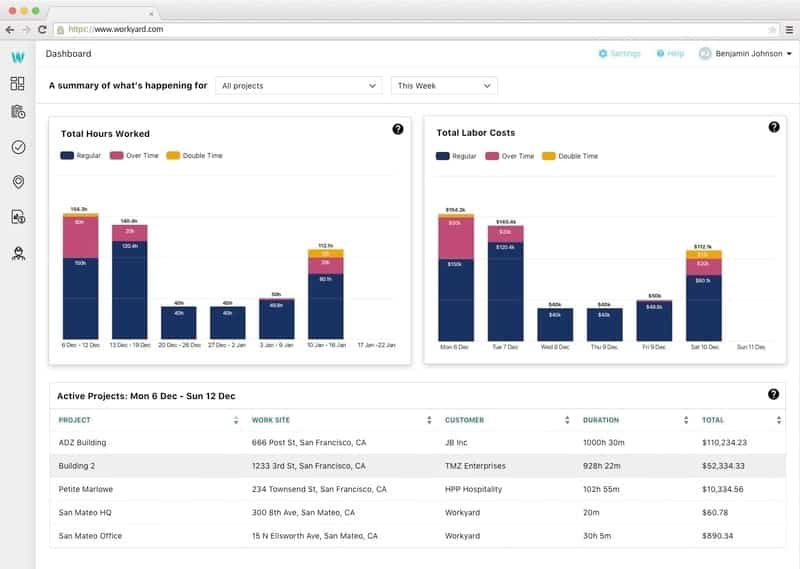

How Workyard Simplifies Your Job Costing By Accurately Capturing Your Labor Costs

Apps like Workyard simplify job costing in QuickBooks by automating how you capture your job related labor costs & helping you track these costs in real-time—so you always know where you stand.

Meanwhile, easy QuickBooks syncing saves you the hassle of manually inputting information into QuickBooks while improving your data’s accuracy.

- Sync job costs with QuickBooks through Workyard. Rather than having to track all your labor costs manually, you can get real, accurate reports on where your employees were throughout the project.

- Avoid having to enter your customer and project information twice. Workyard can sync your customer information with QuickBooks, making tracking your customers and projects much easier.

- Get real-time project-related labor reports in Workyard. Labor is frequently the highest cost in construction. Rather than booting up QuickBooks, look at your labor reports within the Workyard dashboard.

- Accurately track mileage and travel. In addition to labor-related costs, Workyard also makes it easier to track mileage and travel—and allocate those costs to your expense reports.

When you use Workyard along with QuickBooks, you’ll get a much more accurate picture of your labor costs for each of your projects so you can make better, more informed decisions. Use Workyard to quickly pull live reports on how your labor costs are tracking for each of your projects and QuickBooks Online to still get a complete picture of all costs and dig into your vendor and material related expenses.

How Do You Connect Workyard to QuickBooks?

We’ve created simple videos you can follow to sync Workyard to your QuickBooks file.

You can connect Workyard to QuickBooks Online:

The Common Mistakes in QuickBooks Online Job Costing

Mistakes happen—especially when it comes to complex accounting tasks. As you start to pull job costing reports in QuickBooks Online, keep in mind some of the most common mistakes.

- Guessing labor costs because they are too hard to track – If you’re not tracking your labor with a gps time clock app, the chances are you’re probably overpaying your team for inaccurate hours logged and also incorrectly attributing those costs to projects. This is really hard to track manually, leverage technology to make it easier and spend less time on cumbersome admin.

- Failing to track billable and non-billable hours. It’s crucial to track billable and non-billable hours and keep your billable and non-billable hours separate. Otherwise, you won’t thoroughly understand your labor-related costs or your overhead.

- Not allocating indirect costs. Indirect costs are costs not directly allocated to a single job or project. These costs still go under your overhead and affect the profitability of each project. Forgetting to allocate your indirect costs will give you an inaccurate picture of your revenue stream.

- Tracking your data too late. Apps like Workyard help you track track labor costs in real-time. You can’t track your current profitability through job costing reports if you aren’t entering your expenses until well after a project.

Avoid these mistakes by being as diligent as possible when tracking your job costing data. With accurate job costing reports, you’ll be able to make better decisions about your projects—and keep your business profitable.

Try a Free Trial of Workyard Today

Want to see how Workyard can effortlessly sync with QuickBooks? You can start tracking your company’s labor-related costs in real-time using Workyard’s GPS technology within minutes.

Workyard gives you the power to:

- Track employee hours accurately by projects through GPS-powered technology

- Sync employee hours and labor costs between Workyard and QuickBooks

- Easily pull labor-related job costing reports

But the easiest way to understand the benefits of Workyard is to experience it yourself. Try a free trial of Workyard today to start building your job costing reports—and to take more control over your job costing in QuickBooks.

FAQs

How Do I Categorize Construction Expenses in QuickBooks?

QuickBooks doesn’t have a blanket “Construction” category, but when you create a new QuickBooks file, you can select the type of business you own. QuickBooks will populate its income and expense list with the most common construction expenses, such as “Materials” and “Labor”.

What Is Job Costing in Construction?

In construction, job costing refers to allocating direct and indirect costs to a specific job or project. Job costing helps contractors track the actual cost of a project and compare it to the estimated cost, but you need accurate numbers for your reports to be helpful.

What Is Job Costing in QuickBooks?

In QuickBooks, job costing refers to assigning income and expenses to a specific job or project, so you can better in-progress job costing reports. These in-progress reports compare your estimates to your actual expenses.

How Do I Turn On Job Costing on the QuickBooks Desktop Application?

To turn on job costing on QuickBooks desktop, go to Edit > Preferences > Job & Estimate Preferences. Then, check the “Enable Job Costing” box and click “OK.” When you want to check your job costing, you can look at a project in QuickBooks—you will be able to see the current and estimated costs.