Home Construction Management How To Calculate Labor Burden

How To Calculate Labor Burden

A no nonsense guide to how to calculate labor burden for your business. We cover what expenses are part of labor burden and how to calculate it with examples.

When it comes to profits, labor is a crucial component. In the construction industry, labor costs vary between 30% to 50% of the total project cost. It’s not uncommon for a smaller construction company to have labor costs closer to 50% of total project expenditure.

Contractors spend a lot of time estimating and pricing jobs. Ensuring these estimates factor in the true cost of your labor when it makes up such a large percentage of your budget is critical. Without calculating a labor burden rate for your team, you’re likely not pricing your jobs correctly and putting your profits at risk.

To make sure your business is profitable, you need to consider the whole scope of costs beyond an employee’s salary. Factors like payroll taxes, health care, benefits, training, and increased administrative overhead have made labor more expensive—and you’ll need to account for these additional costs in your calculations.

What Is Labor Burden?

When it comes to profits, labor is a crucial component. In the construction industry, labor costs vary between 30% to 50% of the total project cost. It’s not uncommon for a smaller construction company to have labor costs closer to 50% of total project expenditure. (Tramadol)

Contractors spend a lot of time estimating and pricing jobs. Ensuring these estimates factor in the true cost of your labor when it makes up such a large percentage of your budget is critical. Without calculating a labor burden rate for your team, you’re likely not pricing your jobs correctly and putting your profits at risk.

To make sure your business is profitable, you need to consider the whole scope of costs beyond an employee’s salary. Factors like payroll taxes, health care, benefits, training, and increased administrative overhead have made labor more expensive—and you’ll need to account for these additional costs in your calculations.

Today, we’re going to step through what costs you should include in your labor burden rate, show you how to calculate a labor burden rate and how to leverage the burden rate when estimating.

What Does Labor Burden Cover?

Labor burden is related to the indirect costs of your labor—in other words, the cost of having that labor. Indirect labor costs include:

- Payroll taxes.

- Vacation pay.

- Profit-sharing arrangements.

- Liability & automotive insurance.

- Workers compensation insurance.

- Health insurance and other benefits.

- Vehicle expenses.

- Additional training or classes.

- Safety gear, employee equipment, or employee supplies.

- Administrative overhead, time spent in meetings, or time commuting.

It’s a common mistake to bid a job based solely on direct labor costs and without including your labor burden cost. While the direct labor costs could be $20 an hour, the total cost factoring in the labor burden cost could be closer to $30 or even $40 an hour.

Its often convenient to calculate a labor burden rate to use across your company as it makes estimating easier and ensures you are always covering your complete labor burden costs. A labor burden rate is simply a percentage markup you apply to the employee pay rate to determine their total cost including labor burden.

On average, an employee’s labor burden rate ranges from 24% (which translates to $0.24 on the dollar) for private industry and civilian workers, to over 38% for state and local government workers based on the latest data from the U.S. Bureau of Labor Statistics.

Check out our handy online Labor Burden Calculator to calculate the labor burden rate for your employees.

How To Calculate Labor Burden

Calculating your labor burden rate is simple, but you need to make you begin with accurate numbers for all of your indirect costs. Take a look at the following example:

- An employee works for 40 hours at $20 per hour on a project. Their direct cost of labor is $20 x 40 = $800.

- If the employee’s indirect labor costs are $200 (explained further below), that employee’s total labor cost is $800 + $200 = $1,000. So when factoring in the indirect costs, the true cost is $1,000 per 40 hours of work.

- This breaks down to a labor burden rate of $25 per hour ($1,000 / 40).

In the above example, the labor burden rate is 25% or $5 per hour. The hardest part in calculating a labor burden rate is making sure you have accurate numbers for your employee’s total hours worked and also all of the indirect costs for your labor.

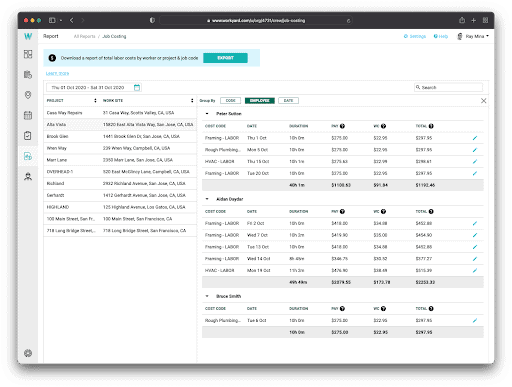

One solution to take the pain out of capturing and tracking hours accurately for all of your employees, use a GPS time clock app that tracks your employees when they’re on-site—booking their hours down to the minute.

Once you have the right numbers in hand, you can start calculating your labor burden rate.

1. Begin with the total hours worked.

Any time your employee is “on the clock” and getting paid will factor into calculating a labor burden rate—even if these aren’t part of the employee’s on-site hours.

2. Calculate your direct labor costs.

Next, calculate your direct labor costs by multiplying the total hours paid by the employee’s hourly wage.

3. Add your indirect costs.

Next, add up all of the indirect costs associated with supporting your labor. They will vary depending on the type of benefits you provide.

4. Total your actual labor costs.

Now, you should have your total Labor Costs: Direct Costs + Indirect Costs.

$10,040.00 + $3,410.00 = $13,450.00

5. Finally, calculate your labor burden rate.

Divide your total Labor Costs by your On-Site Hours (not your Total Hours) to calculate the amount each on-site hour actually costs you.

$13,450.00 / 480 = $28.02

Next, deduct your Hourly Wages from your total Hourly Labor to get your total Indirect Costs.

$28.02 – $20.00 = $8.02

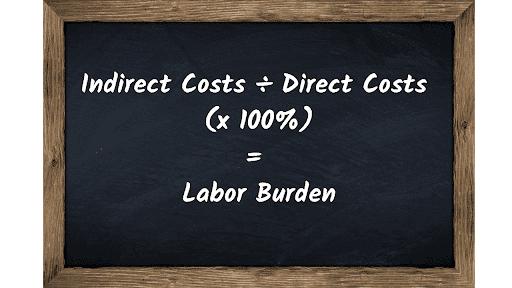

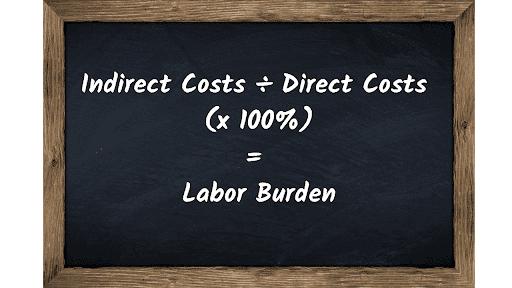

Your Labor Burden Rate is your Indirect Costs divided by your Direct Costs, expressed as a percentage:

Labor Burden Rate = $8.02 / $20.00 x 100 = 40.11%$8.02 / $20.00 x 100 = 40.11%

Check out our free online labor burden calculator to quickly estimate the labor burden rate for your employees.

50,000+ professionals trust Workyard for construction workforce management.

Find out why

How Often You Need to Recalculate Your Labor Burden Rate

Indirect costs can change over time so it’s a good idea to regularly recalculate your labor burden rate at least once a year or when you know there have been major changes to your indirect costs that are likely to affect it.

And don’t forget—to calculate the true cost of your labor, you also need to have an accurate accounting of your hours. Use construction time tracking software to:

- Ensure the accuracy of employee hours captured

- Understand how many hours are being on projects vs non-billable work

- Track and improve construction crew productivity.

- Make the process of calculating your labor burden a whole lot easier. You’re more likely to do it if it’s easy!

Labor Burden Rate FAQs

How do you calculate the fully burdened labor rate?

The fully burdened labor rate is essentially the gross payroll labor cost + the labor burden cost. It is the same thing as what we have been referring to in this article as the total hourly cost of an employee.

What is labor burden in construction?

Calculating the labor burden rate in construction is no different to the method we have outlined here in this article. it applies to all businesses. However, using a labor burden rate when estimating work is particularly critical to construction companies given the tight margins in the industry.

The indirect costs for a construction business can be particularly high and difficult to track, making it even have a bigger impact on the bottom line. For example, in states such as California worker’s compensation rates alone can be as high as 15% of gross wages alone.

If you are a construction business that doesn’t have a good understanding of your true labor burden costs you are risking underestimating jobs and this will eat into your profits.

Is labor burden part of overhead?

Overhead expenses are the fixed or indirect expenses associated with operating your business. This includes expenses such as rent, legal, office supplies, marketing costs, etc. The key difference is that labor burden encompasses the overhead costs directly associated with labor, whereas overhead expenses are not directly tied to your cost of labor. In other words, your labor burden is a component of your total overhead expenses.

What are the lead causes of changes in labor burden rate?

Changing the benefits you offer employees is often a major driver for changes in the labor burden rate. For example, offering health benefits. Changes in your worker’s compensation insurance mod rate and the rates you pay for different professions can also have a significant impact on your burden rate, especially in states such as California that have high premiums.

For more information, check out the following resources: