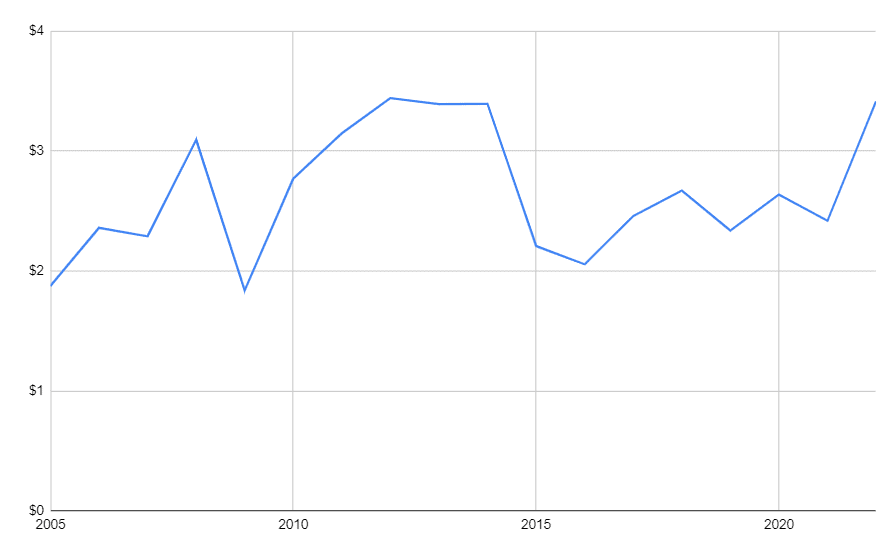

The IRS sets a standard mileage reimbursement rate, which is used by many businesses to calculate employee mileage reimbursement. For 2023, this rate is 65.5 cents per mile for business use. The rate is meant to cover costs such as fuel, maintenance, depreciation, and insurance. However, businesses are not required to use the IRS rate—they can set their own. When setting a different rate, ensure it fairly compensates employees and complies with any state laws to avoid legal issues. Keep in mind that rates are updated annually, so it’s essential to stay informed about changes.

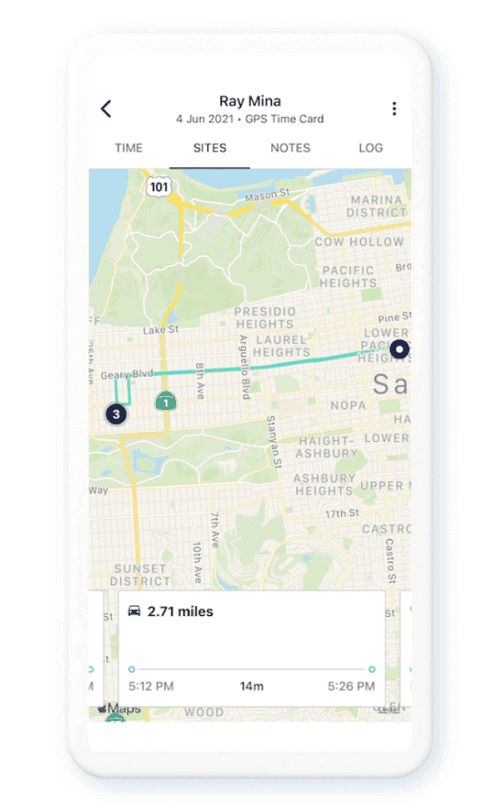

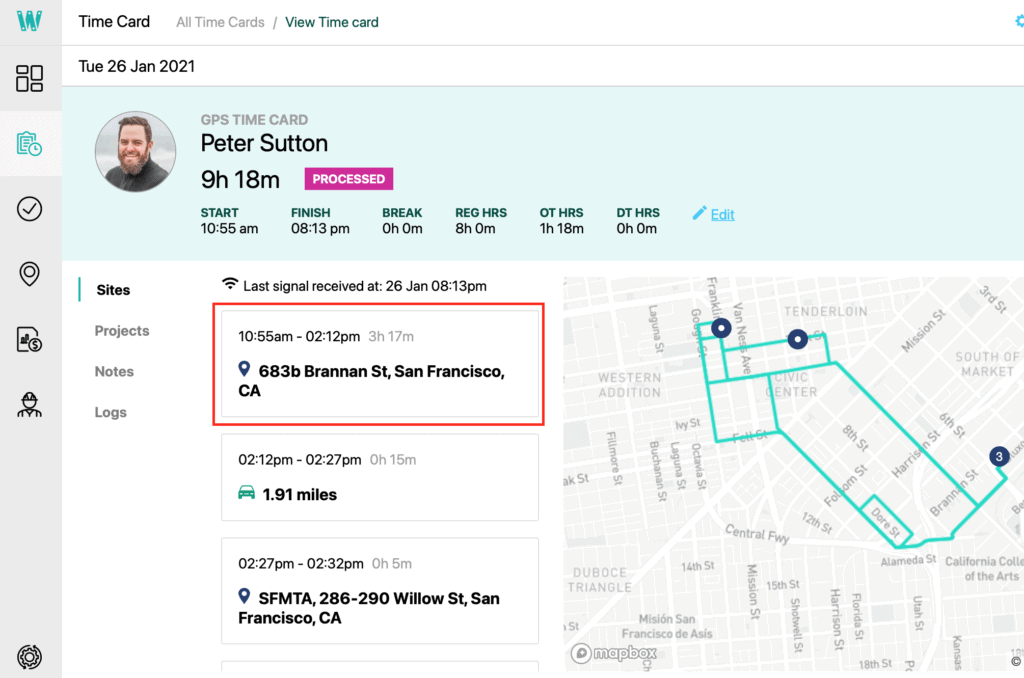

For remote employees, mileage reimbursement typically applies when they use their personal vehicle for work-related travel, excluding their normal commute from home to work. Common reimbursable trips include driving to client meetings, job sites, or company events. Clear policies should be established to define eligible trips and ensure consistency. Using mileage tracking apps can simplify this process, helping employees log their trips accurately and ensuring compliance with company policies and IRS regulations.

Mileage reimbursement is generally not considered taxable income if it falls within the IRS standard mileage rate and follows an accountable plan. An accountable plan requires employees to document their business-related miles and submit them to their employer for reimbursement. If reimbursement exceeds the IRS rate or is not properly documented, it may be treated as taxable income. Employers should carefully track mileage and maintain thorough records to ensure tax compliance and avoid penalties.

Mileage reimbursement compensates employees based on the miles they drive for work-related purposes, typically at a set rate per mile. A car allowance, however, is a fixed sum provided to employees for vehicle expenses, regardless of the miles driven. While a car allowance offers simplicity, it may not accurately reflect an employee’s actual driving costs. In contrast, mileage reimbursement directly correlates to the amount of driving performed, which can be more equitable and cost-effective.

To reduce costs, businesses can adopt mileage tracking apps to improve accuracy, preventing overestimated mileage claims. Encouraging employees to carpool when feasible and reviewing routes for efficiency can minimize unnecessary miles. Implementing a capped reimbursement policy, setting guidelines for eligible trips, and using the IRS mileage rate as a benchmark can also help control expenses. Additionally, offering alternatives like public transit reimbursements or company vehicles might further reduce overall reimbursement costs.